If 'ol Fashioned Toys' Revenues Are Less Than Its Expenses During the Accounting Period, Then

Introduction to Financial Statements

ten Prepare an Income Statement, Statement of Owner'south Disinterestedness, and Rest Sheet

One of the key factors for success for those beginning the study of accounting is to empathise how the elements of the financial statements chronicle to each of the fiscal statements. That is, once the transactions are categorized into the elements, knowing what to do next is vital. This is the outset of the process to create the financial statements. It is important to note that financial statements are discussed in the order in which the statements are presented.

Elements of the Financial Statements

When thinking of the relationship between the elements and the fiscal statements, nosotros might think of a baking analogy: the elements represent the ingredients, and the financial statements represent the finished product. Equally with baking a cake (see (Figure)), knowing the ingredients (elements) and how each ingredient relates to the terminal product (financial statements) is vital to the report of bookkeeping.

Baking requires an understanding of the different ingredients, how the ingredients are used, and how the ingredients will touch the terminal production (a). If used correctly, the final product will be beautiful and, more importantly, delicious, like the block shown in (b). In a similar manner, the written report of bookkeeping requires an agreement of how the bookkeeping elements relate to the final product—the financial statements. (credit (a): modification of "U.S. Navy Culinary Specialist Seaman Robert Fritschie mixes block batter aboard the amphibious control send USS Blue Ridge (LCC 19) Aug. 7, 2013, while underway in the Solomon Bounding main 130807-N-NN332-044" past MC3 Jarred Harral/Wikimedia Commons, Public Domain; credit (b): modification of "Easter Cake with Colorful Topping" past Kaboompics .com/Pexels, CC0)

To help accountants prepare and users amend understand financial statements, the profession has outlined what is referred to as elements of the financial statements, which are those categories or accounts that accountants apply to record transactions and set financial statements. There are x elements of the financial statements, and we take already discussed most of them.

- Revenue—value of goods and services the arrangement sold or provided.

- Expenses—costs of providing the goods or services for which the organization earns revenue.

- Gains—gains are similar to acquirement but relate to "incidental or peripheral" activities of the arrangement.

- Losses—losses are similar to expenses but related to "incidental or peripheral" activities of the system.

- Assets—items the organization owns, controls, or has a claim to.

- Liabilities—amounts the organization owes to others (likewise called creditors).

- Equity—the net worth (or net avails) of the organization.

- Investment past owners—cash or other assets provided to the organization in exchange for an ownership interest.

- Distribution to owners—cash, other assets, or buying interest (equity) provided to owners.

- Comprehensive income—defined every bit the "change in equity of a business organisation enterprise during a period from transactions and other events and circumstances from nonowner sources" (SFAC No. 6, p. 21). While further word of comprehensive income is reserved for intermediate and advanced studies in accounting, it is worth noting that comprehensive income has four components, focusing on activities related to foreign currency, derivatives, investments, and pensions.

Financial Statements for a Sample Company

At present it is time to broil the cake (i.e., prepare the financial statements). We have all of the ingredients (elements of the financial statements) ready, so let's now return to the financial statements themselves. Let'southward utilize as an example a fictitious company named Cheesy Chuck's Classic Corn. This company is a pocket-size retail store that makes and sells a variety of gourmet popcorn treats. It is an exciting time considering the store opened in the current month, June.

Assume that as part of your summer job with Cheesy Chuck'southward, the owner—you guessed it, Chuck—has asked you to take over for a erstwhile employee who graduated college and will exist taking an accounting job in New York City. In add-on to your duties involving making and selling popcorn at Cheesy Chuck'southward, part of your responsibility volition exist doing the accounting for the business. The owner, Chuck, heard that y'all are studying bookkeeping and could really use the aid, considering he spends most of his time developing new popcorn flavors.

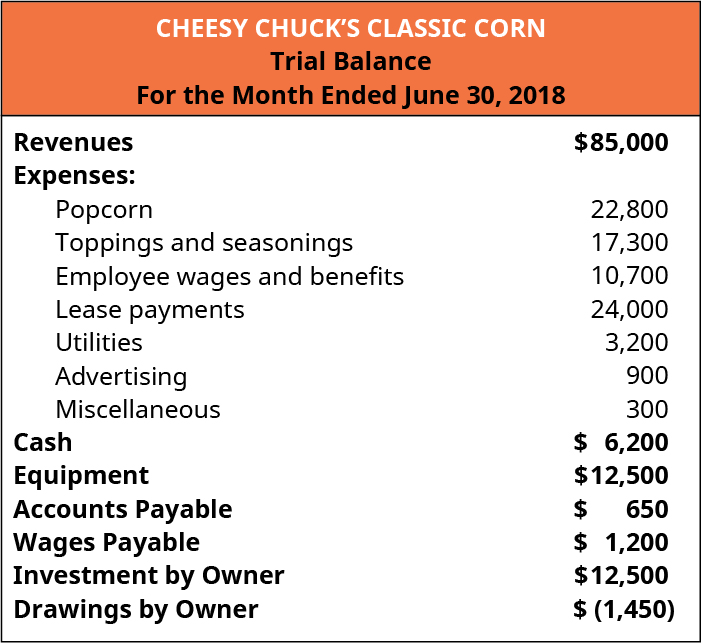

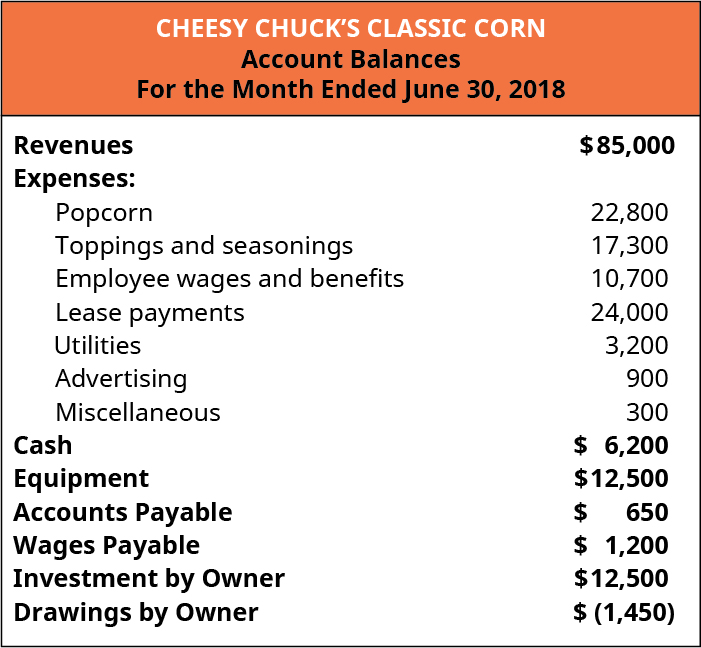

The onetime employee has done a overnice task of keeping track of the accounting records, so you can focus on your offset task of creating the June fiscal statements, which Chuck is eager to see. (Figure) shows the financial data (as of June thirty) for Cheesy Chuck'southward.

Trial Remainder for Cheesy Chuck'due south Classic Corn. Accountants record and summarize bookkeeping information into accounts, which help to track, summarize, and set accounting information. This table is a variation of what accountants call a "trial balance." A trial residue is a summary of accounts and aids accountants in creating financial statements. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

We should annotation that we are oversimplifying some of the things in this case. First, the amounts in the accounting records were given. Nosotros did non explain how the amounts would exist derived. This process is explained starting in Analyzing and Recording Transactions. 2nd, we are ignoring the timing of certain cash flows such every bit hiring, purchases, and other startup costs. In reality, businesses must invest cash to gear up the store, train employees, and obtain the equipment and inventory necessary to open. These costs will precede the selling of goods and services. In the case to follow, for instance, nosotros utilise Lease payments of ?24,000, which represents lease payments for the building (?twenty,000) and equipment (?4,000). In practise, when companies lease items, the accountants must determine, based on accounting rules, whether or not the concern "owns" the item. If it is determined the business "owns" the building or equipment, the item is listed on the residue sheet at the original toll. Accountants likewise take into account the building or equipment'southward value when the particular is worn out. The deviation in these two values (the original cost and the ending value) will be allocated over a relevant menses of fourth dimension. Equally an case, assume a business purchased equipment for ?eighteen,000 and the equipment will be worth ?2,000 after 4 years, giving an estimated reject in value (due to usage) of ?16,000 (?18,000 − ?2,000). The business will allocate ?iv,000 of the equipment cost over each of the four years (?18,000 minus ?2,000 over four years). This is called depreciation and is ane of the topics that is covered in Long-Term Avails.

Also, the Equipment with a value of ?12,500 in the financial information provided was purchased at the terminate of the first bookkeeping menses. It is an nugget that will be depreciated in the future, but no depreciation expense is allocated in our example.

Income Argument

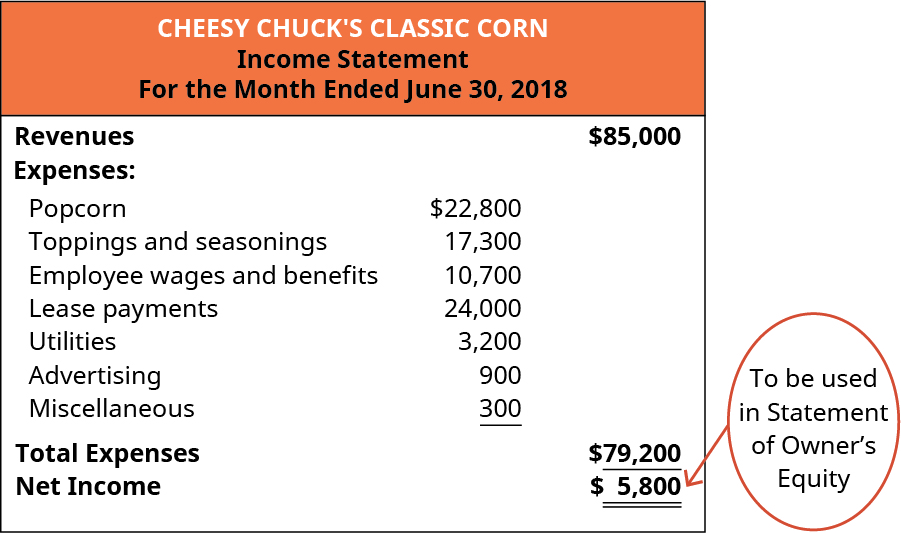

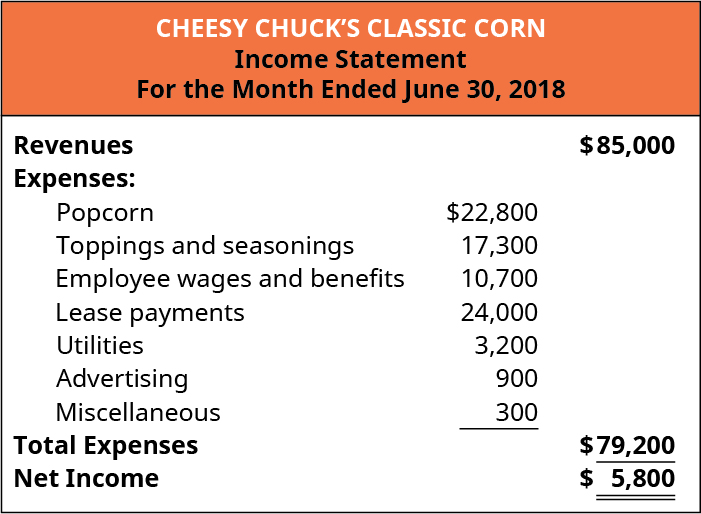

Let's prepare the income statement so we can inform how Cheesy Chuck'southward performed for the month of June (call up, an income argument is for a period of time). Our first pace is to decide the value of goods and services that the system sold or provided for a given period of time. These are the inflows to the concern, and because the inflows relate to the primary purpose of the business (making and selling popcorn), we classify those items as Revenues, Sales, or Fees Earned. For this example, we use Revenue. The acquirement for Cheesy Chuck'southward for the calendar month of June is ?85,000.

Adjacent, we need to show the total expenses for Cheesy Chuck'due south. Because Cheesy Chuck's tracks different types of expenses, nosotros need to add together the amounts to calculate total expenses. If yous added correctly, y'all get full expenses for the calendar month of June of ?79,200. The last stride to create the income statement is to determine the corporeality of internet income or net loss for Cheesy Chuck'southward. Since revenues (?85,000) are greater than expenses (?79,200), Cheesy Chuck'south has a internet income of ?5,800 for the month of June.

(Figure) displays the June income statement for Cheesy Chuck's Archetype Corn.

Income Statement for Cheesy Chuck'south Classic Corn. The income statement for Cheesy Chuck'due south shows the concern had Internet Income of ?five,800 for the month ended June 30. This corporeality will exist used to prepare the adjacent financial statement, the statement of owner's equity. (attribution: Copyright Rice Academy, OpenStax, under CC Past-NC-SA 4.0 license)

Fiscal statements are created using numerous standard conventions or practices. The standard conventions provide consistency and help clinch financial argument users the information is presented in a similar manner, regardless of the organization issuing the financial statement. Let's look at the standard conventions shown in the Cheesy Chuck's income argument:

- The heading of the income statement includes three lines.

- The first line lists the business organisation name.

- The middle line indicates the financial statement that is beingness presented.

- The last line indicates the time frame of the fiscal argument. Do not forget the income statement is for a period of fourth dimension (the month of June in our example).

- There are three columns.

- Going from left to right, the first column is the category heading or account.

- The 2d column is used when there are numerous accounts in a item category (Expenses, in our instance).

- The tertiary column is a total cavalcade. In this illustration, it is the column where subtotals are listed and cyberspace income is determined (subtracting Expenses from Revenues).

- Subtotals are indicated past a single underline, while totals are indicated by a double underline. Observe the amount of Miscellaneous Expense (?300) is formatted with a single underline to indicate that a subtotal volition follow. Similarly, the amount of "Cyberspace Income" (?5,800) is formatted with a double underline to betoken that it is the final value/total of the fiscal statement.

- There are no gains or losses for Cheesy Chuck's. Gains and losses are not unusual transactions for businesses, merely gains and losses may be exceptional for some, particularly small, businesses.

McDonald's

For the yr ended December 31, 2016, McDonald's had sales of ?24.vi billion.1 The corporeality of sales is ofttimes used past the business equally the starting point for planning the next yr. No doubtfulness, in that location are a lot of people involved in the planning for a business the size of McDonald'southward. Two key people at McDonald's are the purchasing manager and the sales director (although they might have dissimilar titles). Permit's await at how McDonald's 2016 sales amount might be used past each of these individuals. In each case, do not forget that McDonald'south is a global visitor.

A purchasing manager at McDonald's, for example, is responsible for finding suppliers, negotiating costs, arranging for delivery, and many other functions necessary to have the ingredients fix for the stores to prepare the food for their customers. Expecting that McDonald's will take over ?24 billion of sales during 2017, how many eggs practise you remember the purchasing managing director at McDonald'southward would need to purchase for the year? Co-ordinate to the McDonald's website, the company uses over two billion eggs a year.2 Accept a moment to list the details that would have to exist coordinated in order to purchase and evangelize over 2 billion eggs to the many McDonald'due south restaurants around the globe.

A sales managing director is responsible for establishing and attaining sales goals within the company. Assume that McDonald's 2017 sales are expected to exceed the amount of sales in 2016. What conclusions would you brand based on this information? What do y'all think might be influencing these amounts? What factors do yous think would be of import to the sales managing director in deciding what activeness, if whatever, to take? Now presume that McDonald's 2017 sales are expected to exist below the 2016 sales level. What conclusions would you brand based on this information? What practise y'all think might exist influencing these amounts? What factors practise yous remember would exist important to the sales manager in deciding what activity, if any, to accept?

Statement of Owner's Equity

Let's create the statement of possessor'southward equity for Cheesy Chuck'due south for the calendar month of June. Since Cheesy Chuck's is a make-new business organisation, there is no beginning balance of Owner's Equity. The outset items to account for are the increases in value/equity, which are investments by owners and cyberspace income. Every bit you look at the bookkeeping data y'all were provided, yous recognize the amount invested past the owner, Chuck, was ?12,500. Next, we account for the increase in value as a upshot of net income, which was determined in the income argument to be ?5,800. Next, we determine if at that place were any activities that decreased the value of the business organization. More specifically, we are bookkeeping for the value of distributions to the owners and net loss, if any.

It is important to notation that an organization volition have either net income or net loss for the flow, simply not both. Likewise, small businesses in particular may accept periods where there are no investments by, or distributions to, the owner(due south). For the month of June, Chuck withdrew ?1,450 from the business. This is a practiced time to call back the terminology used by accountants based on the legal structure of the item business. Since the account was titled "Drawings by Owner" and because Chuck is the only owner, we tin can assume this is a sole proprietorship. If the business was structured equally a corporation, this activity would be called something like "Dividends Paid to Owners."

At this stage, remember that since we are working with a sole proprietorship to assist simplify the examples, we have addressed the possessor's value in the firm as majuscule or owner'south equity. However, later we switch the construction of the business to a corporation, and instead of possessor'southward disinterestedness, we begin using such business relationship titles equally common stock and retained earnings to represent the owner'south interests. The corporate treatment is more complicated, considering corporations may have a few owners up to potentially thousands of owners (stockholders). The details of accounting for the interests of corporations are covered in Corporation Accounting.

Then how much did the value of Cheesy Chuck's change during the calendar month of June? You are correct if you lot answered ?sixteen,850. Since this is a brand-new shop, the beginning value of the business organisation is zero. During the month, the owner invested ?12,500 and the business had profitable operations (net income) of ?v,800. Too, during the calendar month the possessor withdrew ?ane,450, resulting in a net alter (and catastrophe balance) to owner's equity of ?16,850. Shown in a formula:

Get-go Balance + Investments by Owners ± Internet Income (Net Loss) – Distributions, or

\(?0+?12,500+?five,800–?i,450=?16,850\)

(Figure) shows what the argument of owner's disinterestedness for Cheesy Chuck's Classic Corn would look like.

Argument of Owner's Equity for Cheesy Chuck'south Classic Corn. The argument of possessor's equity demonstrates how the net worth (besides chosen equity) of the business changed over the period of time (the month of June in this case). Notice the amount of cyberspace income (or cyberspace loss) is brought from the income argument. In a similar manner, the ending equity balance (Capital for Cheesy Chuck'southward because it is a sole proprietorship) is carried frontward to the balance sheet. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA iv.0 license)

![Cheesy Chuck's Classic Corn, Statement of Owner's Equity, For the month Ended June 30, 2018. Chuck, Capital: June 1, 2018 💲0; Increases: Investments by owner 💲12,500, Net income for the month of june, 2018 [obtained from the income statement] 5,800. Total Increase 18,300. Decreases: Drawings by owner (1,450). Total Decrease (1,450); Chuck, Capital: June 30, 2018 💲16,850 [To be used in Balance Sheet]](https://opentextbc.ca/principlesofaccountingv1openstax/wp-content/uploads/sites/267/2019/07/OSX_Acct_F02_03_ChuckSOE.jpg)

Notice the post-obit about the argument of owner'southward equity for Cheesy Chuck'due south:

- The format is like to the format of the income argument (3 lines for the heading, three columns).

- The argument follows a chronological lodge, starting with the first day of the month, accounting for the changes that occurred throughout the month, and catastrophe with the terminal day of the month.

The statement uses the concluding number from the financial statement previously completed. In this case, the statement of owner'south equity uses the internet income (or internet loss) amount from the income statement (Internet Income, ?5,800).

Remainder Sheet

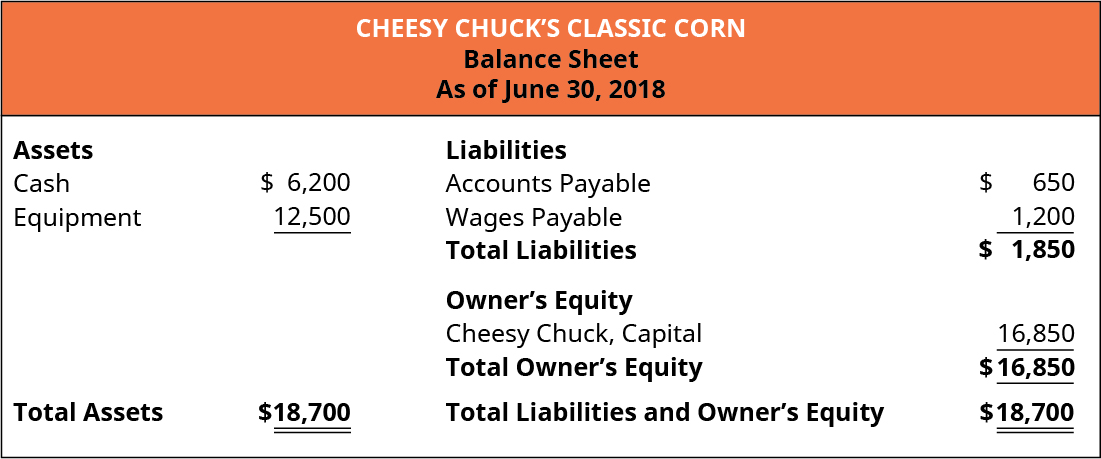

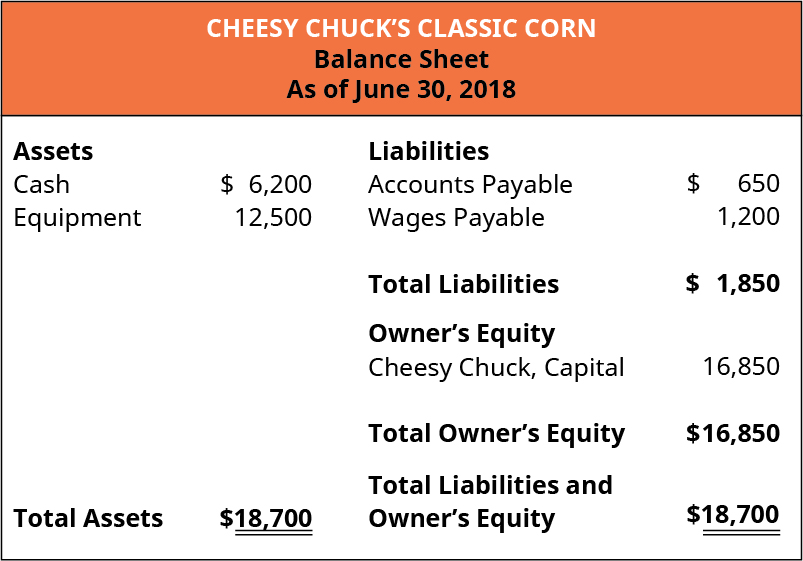

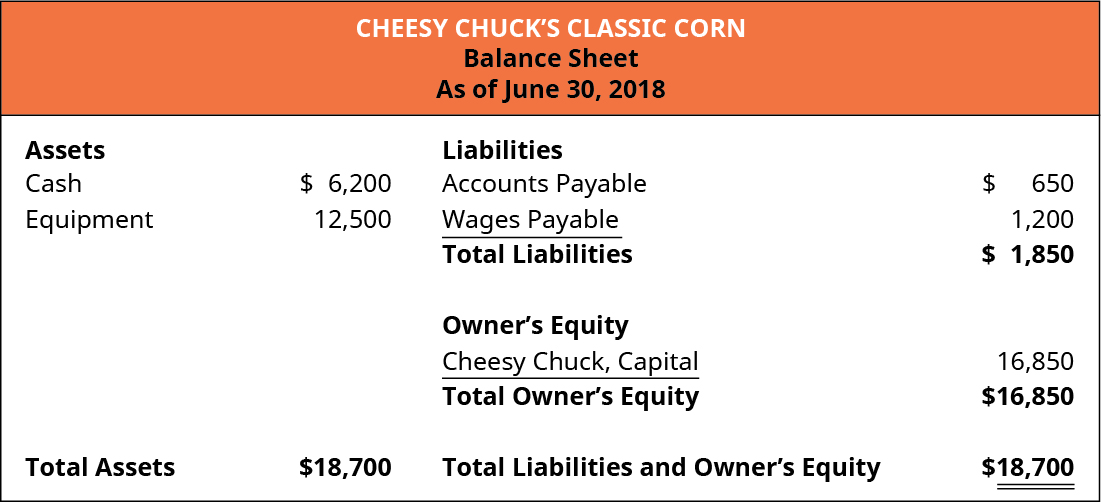

Allow's create a balance sheet for Cheesy Chuck'south for June 30. To brainstorm, nosotros wait at the bookkeeping records and decide what avails the business owns and the value of each. Cheesy Chuck'due south has two assets: Cash (?half dozen,200) and Equipment (?12,500). Adding the amount of assets gives a full asset value of ?18,700. As discussed previously, the equipment that was recently purchased will be depreciated in the future, beginning with the next bookkeeping period.

Next, we make up one's mind the amount of money that Cheesy Chuck'south owes (liabilities). In that location are also 2 liabilities for Cheesy Chuck's. The starting time business relationship listed in the records is Accounts Payable for ?650. Accounts Payable is the amount that Cheesy Chuck'southward must pay in the future to vendors (too chosen suppliers) for the ingredients to brand the gourmet popcorn. The other liability is Wages Payable for ?one,200. This is the amount that Cheesy Chuck's must pay in the future to employees for work that has been performed. Adding the 2 amounts gives us total liabilities of ?1,850. (Here's a hint as you develop your understanding of accounting: Liabilities oft include the word "payable." And then, when you encounter "payable" in the account championship, know these are amounts owed in the future—liabilities.)

Finally, we determine the amount of equity the owner, Cheesy Chuck, has in the business. The amount of possessor'south equity was determined on the statement of owner's disinterestedness in the previous step (?16,850). Can you think of another style to ostend the amount of owner's equity? Recall that equity is also called net assets (assets minus liabilities). If y'all take the total assets of Cheesy Chuck's of ?18,700 and subtract the total liabilities of ?i,850, you lot get owner's equity of ?16,850. Using the basic accounting equation, the balance sail for Cheesy Chuck'due south as of June 30 is shown in (Effigy).

Balance Canvas for Cheesy Chuck's Classic Corn. The balance sheet shows what the business owns (Assets), owes (Liabilities), and is worth (equity) on a given engagement. Discover the corporeality of Owner's Equity (Capital for Cheesy Chuck'southward) was brought frontwards from the statement of owner's disinterestedness. (attribution: Copyright Rice University, OpenStax, nether CC By-NC-SA 4.0 license)

Connecting the Income Statement and the Balance Canvass

Some other fashion to retrieve of the connection betwixt the income argument and balance sail (which is aided past the statement of owner's disinterestedness) is by using a sports analogy. The income statement summarizes the financial performance of the concern for a given period of fourth dimension. The income statement reports how the business performed financially each month—the firm earned either net income or internet loss. This is similar to the upshot of a particular game—the team either won or lost.

The balance sheet summarizes the financial position of the business organisation on a given date. Meaning, considering of the financial performance over the past twelve months, for instance, this is the financial position of the business as of December 31. Retrieve of the remainder sail as being similar to a squad's overall win/loss record—to a certain extent a team'southward force can be perceived by its win/loss tape.

Nevertheless, because different companies have different sizes, you do not necessarily desire to compare the residual sheets of 2 unlike companies. For case, you lot would not want to compare a local retail shop with Walmart. In virtually cases you desire to compare a visitor with its past residuum sheet information.

Creating Financial Statements: A Summary

In this instance using a fictitious company, Cheesy Chuck's, we began with the business relationship balances and demonstrated how to prepare the financial statements for the month of June, the first month of operations for the concern. It will exist helpful to revisit the procedure by summarizing the information we started with and how that information was used to create the iv financial statements: income argument, statement of owner'due south equity, balance sheet, and statement of cash flows.

Nosotros started with the account balances shown in (Figure).

Account Balances for Cheesy Chuck's Classic Corn. Obtaining the account balances is the starting signal for preparing financial statements. (attribution: Copyright Rice University, OpenStax, nether CC By-NC-SA 4.0 license)

The next step was to create the income statement, which shows the financial operation of the business. The income argument is shown in (Figure).

Income Statement for Cheesy Chuck's Classic Corn. The income statement uses information from the trial balance, which lists the accounts and account totals. The income argument shows the financial functioning of a business for a menstruation of time. The net income or net loss will exist carried forward to the statement of owner's disinterestedness. (attribution: Copyright Rice Academy, OpenStax, nether CC Past-NC-SA 4.0 license)

Next, nosotros created the statement of possessor'south equity, shown in (Effigy). The statement of owner's equity demonstrates how the disinterestedness (or cyberspace worth) of the concern changed for the month of June. Practise not forget that the Cyberspace Income (or Internet Loss) is carried frontwards to the statement of owner's equity.

Argument of Owner's Disinterestedness for Cheesy Chuck'due south Classic Corn. The statement of owner'southward equity shows how the net worth/value (or disinterestedness) of business organisation changed for the flow of time. This statement includes Internet Income (or Internet Loss), which was brought forwards from the income argument. The catastrophe residuum is carried forward to the balance sheet. (attribution: Copyright Rice University, OpenStax, nether CC BY-NC-SA 4.0 license)

![Cheesy Chuck's Classic Corn, Statement of Owner's Equity, For the month Ended June 30, 2018. Chuck, Capital: June 1, 2018 💲0; Increases: Investments by owner 💲12,500, Net income for the month of june, 2018 [obtained from the income statement] 5,800. Total Increase 18,300. Decreases: Drawings by owner (1,450). Total Decrease (1,450); Chuck, Capital: June 30, 2018 💲16,850 [To be used in Balance Sheet].](https://opentextbc.ca/principlesofaccountingv1openstax/wp-content/uploads/sites/267/2019/07/OSX_Acct_F02_03_ChuckSum03.jpg)

The 3rd financial statement created is the balance sheet, which shows the company's financial position on a given appointment. Cheesy Chuck'south balance sheet is shown in (Figure).

Balance Sail for Cheesy Chuck'southward Classic Corn. The balance sheet shows the assets, liabilities, and owner's equity of a business on a given appointment. Notice the residual sheet is the accounting equation in fiscal statement form: Assets = Liabilities + Possessor's Disinterestedness. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

Fiscal Argument Analysis

In Why Information technology Matters, nosotros pointed out that accounting data from the financial statements can be useful to concern owners. The financial statements provide feedback to the owners regarding the fiscal operation and financial position of the business, helping the owners to make decisions about the business.

Using the June financial statements, analyze Cheesy Chuck's and prepare a brief presentation. Consider this from the perspective of the owner, Chuck. Depict the financial performance of and financial position of the business. What areas of the business would you want to clarify further to get boosted information? What changes would y'all consider making to the business organisation, if any, and why or why not?

Financial Statement Manipulation at Waste Management Inc.

Accountants have an upstanding duty to accurately report the financial results of their company and to ensure that the visitor's annual reports communicate relevant information to stakeholders. If accountants and company management fail to do so, they may incur heavy penalties.

For example, in 2002 the Securities and Substitution Commission (SEC) charged the acme direction of Waste Direction, Inc. with inflating profits past ?1.7 billion to see earnings targets in the period 1992–1997. An SEC press release alleged "that defendants fraudulently manipulated the visitor'south fiscal results to meet predetermined earnings targets. . . . They employed a multitude of improper accounting practices to attain this objective."3 The defendants in the example manipulated reports to defer or eliminate expenses, which fraudulently inflated their earnings. Because they failed to accurately written report the financial results of their company, the meridian accountants and management of Waste Management, Inc. face up charges.

Thomas C. Newkirk, the acquaintance director of the SEC'south Partition of Enforcement, stated, "For years, these defendants cooked the books, enriched themselves, preserved their jobs, and duped unsuspecting shareholders"4 The defendants, who included members of the visitor board and executives, benefited personally from their fraud in the millions of dollars through performance-based bonuses, charitable giving, and sale of company stock. The company's bookkeeping class, Arthur Andersen, abetted the fraud by identifying the improper practices but doing little to cease them.

Liquidity Ratios

In addition to reviewing the financial statements in order to make decisions, owners and other stakeholders may likewise use financial ratios to assess the financial wellness of the organization. While a more than in-depth discussion of fiscal ratios occurs in Appendix A: Fiscal Argument Analysis, hither nosotros innovate liquidity ratios, a common, easy, and useful way to analyze the fiscal statements.

Liquidity refers to the business organization'south ability to convert assets into cash in guild to meet curt-term greenbacks needs. Examples of the most liquid assets include accounts receivable and inventory for merchandising or manufacturing businesses. The reason these are among the near liquid assets is that these avails will be turned into cash more chop-chop than state or buildings, for example. Accounts receivable represents goods or services that have already been sold and volition typically exist paid/nerveless inside thirty to twoscore-5 days. Inventory is less liquid than accounts receivable because the product must first be sold before it generates greenbacks (either through a cash sale or sale on account). Inventory is, however, more liquid than land or buildings considering, under most circumstances, information technology is easier and quicker for a business to discover someone to purchase its appurtenances than information technology is to find a buyer for country or buildings.

Working Upper-case letter

The starting bespeak for understanding liquidity ratios is to define working capital—electric current assets minus electric current liabilities. Think that current assets and current liabilities are amounts generally settled in 1 year or less. Working capital (current avails minus current liabilities) is used to assess the dollar amount of assets a business has bachelor to encounter its short-term liabilities. A positive working capital letter amount is desirable and indicates the business concern has sufficient current assets to meet curt-term obligations (liabilities) and notwithstanding has fiscal flexibility. A negative amount is undesirable and indicates the business organisation should pay item attention to the composition of the current assets (that is, how liquid the current assets are) and to the timing of the current liabilities. It is unlikely that all of the current liabilities will exist due at the aforementioned time, only the amount of working capital gives stakeholders of both small-scale and big businesses an indication of the firm'south ability to meet its short-term obligations.

One limitation of working capital is that information technology is a dollar amount, which can be misleading considering business sizes vary. Recall from the word on materiality that ?1,000, for example, is more textile to a small business (like an contained local movie theater) than it is to a large business concern (like a movie theater chain). Using percentages or ratios allows financial statement users to more hands compare pocket-size and large businesses.

Current Ratio

The current ratio is closely related to working capital; it represents the current assets divided by current liabilities. The current ratio utilizes the same amounts equally working upper-case letter (current assets and electric current liabilities) just presents the amount in ratio, rather than dollar, form. That is, the current ratio is defined as current assets/current liabilities. The estimation of the electric current ratio is similar to working capital. A ratio of greater than one indicates that the firm has the ability to meet short-term obligations with a buffer, while a ratio of less than one indicates that the firm should pay close attention to the composition of its current assets as well as the timing of the current liabilities.

Sample Working Capital and Current Ratio Calculations

Assume that Chuck, the owner of Cheesy Chuck's, wants to assess the liquidity of the business organisation. (Figure) shows the June 30, 2018, residuum canvass. Assume the Equipment listed on the residuum sheet is a noncurrent asset. This is a reasonable supposition as this is the first month of performance and the equipment is expected to final several years. We also assume the Accounts Payable and Wages Payable will be paid within ane twelvemonth and are, therefore, classified equally electric current liabilities.

Residue Sheet for Cheesy Chuck'southward Classic Corn. The remainder canvas provides a snapshot of the company's financial position. By showing the total assets, total liabilities, and full disinterestedness of the business, the rest sheet provides information that is useful for decision-making. In add-on, using ratios tin give stakeholders some other view of the visitor, allowing for comparisons to prior periods and to other businesses. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

Working capital letter is calculated as current assets minus current liabilities. Cheesy Chuck's has only two assets, and one of the assets, Equipment, is a noncurrent nugget, so the value of current assets is the cash amount of ?6,200. The working capital letter of Cheesy Chuck's is ?6,200 – ?1,850 or ?4,350. Since this amount is over ?0 (it is well over ?0 in this case), Chuck is confident he has aught to worry about regarding the liquidity of his business.

Let's further assume that Chuck, while attending a popcorn briefing for shop owners, has a chat with the owner of a much larger popcorn store—Helm Caramel'southward. The owner of Captain Caramel'southward happens to share the working capital for his store is ?52,500. At first Chuck feels his business is not doing so well. Merely then he realizes that Helm Caramel's is located in a much bigger city (with more customers) and has been around for many years, which has allowed them to build a solid business, which Chuck aspires to do. How would Chuck compare the liquidity of his new concern, opened just one month, with the liquidity of a larger and more-established business in another marketplace? The answer is by calculating the current ratio, which removes the size differences (materiality) of the two businesses.

The current ratio is calculated as current assets/electric current liabilities. We utilise the same amounts that we used in the working capital letter calculation, merely this time we divide the amounts rather than decrease the amounts. So Cheesy Chuck's electric current ratio is ?half dozen,200 (electric current assets)/?1,850 (current liabilities), or 3.35. This means that for every dollar of electric current liabilities, Cheesy Chuck'south has ?iii.35 of current assets. Chuck is pleased with the ratio simply does not know how this compares to another popcorn shop, so he asked his new friend from Captain Caramel's. The possessor of Captain Caramel's shares that his store has a electric current ratio of iv.25. While it is still meliorate than Cheesy Chuck'southward, Chuck is encouraged to learn that his store is performing at a more than competitive level than he previously idea by comparing the dollar amounts of working majuscule.

IFRS and US GAAP in Financial Statements

Understanding the elements that make up fiscal statements, the organization of those elements inside the financial statements, and what information each statement relays is important, whether analyzing the financial statements of a Us company or i from Honduras. Since virtually US companies use generally accustomed accounting principles (GAAP)five as prescribed by the Financial Bookkeeping Standards Lath (FASB), and most international companies apply some version of the International Fiscal Reporting Standards (IFRS),half-dozen knowing how these 2 sets of accounting standards are similar or unlike regarding the elements of the fiscal statements will facilitate analysis and decision-making.

Both IFRS and US GAAP have the aforementioned elements equally components of financial statements: avails, liabilities, equity, income, and expenses. Equity, income, and expenses take similar subcategorization between the two types of GAAP (United states GAAP and IFRS) as described. For example, income can be in the form of earned income (a lawyer providing legal services) or in the form of gains (interest earned on an investment business relationship). The definition of each of these elements is similar between IFRS and US GAAP, only there are some differences that can influence the value of the account or the placement of the account on the fiscal statements. Many of these differences are discussed in detail later in this course when that element—for instance, the nuances of bookkeeping for liabilities—is discussed. Here is an case to illustrate how these pocket-size differences in definition can impact placement within the financial statements when using US GAAP versus IFRS. ACME Car Rental Company typically rents its cars for a time of two years or 60,000 miles. At the end of whichever of these 2 measures occurs first, the cars are sold. Under both US GAAP and IFRS, the cars are noncurrent assets during the period when they are rented. Once the cars are beingness "held for sale," nether IFRS rules, the cars become current assets. However, under United states of america GAAP, there is no specific rule equally to where to list those "held for sale" cars; thus, they could still list the cars every bit noncurrent assets. As y'all learn more near the assay of companies and financial information, this difference in placement on the financial statements will become more than meaningful. At this bespeak, simply know that financial analysis can include ratios, which is the comparing of two numbers, and thus whatsoever time you alter the denominator or the numerator, the ratio effect volition change.

There are many similarities and some differences in the actual presentation of the various financial statements, but these are discussed in The Aligning Process at which point these similarities and differences will be more meaningful and easier to follow.

Key Concepts and Summary

- There are ten fiscal statement elements: revenues, expenses, gains, losses, assets, liabilities, equity, investments by owners, distributions to owners, and comprehensive income.

- There are standard conventions for the order of preparing financial statements (income statement, argument of owner's equity, balance sheet, and statement of greenbacks flows) and for the format (iii-line heading and columnar structure).

- Financial ratios, which are calculated using fiscal statement information, are frequently benign to aid in fiscal decision-making. Ratios allow for comparisons between businesses and determining trends between periods within the same business.

- Liquidity ratios appraise the firm's ability to convert avails into greenbacks.

- Working Capital (Current Avails – Current Liabilities) is a liquidity ratio that measures a firm'south ability to run across current obligations.

- The Current Ratio (Current Avails/Electric current Liabilities) is similar to Working Uppercase but allows for comparisons between firms by determining the proportion of current assets to current liabilities.

Multiple Selection

(Effigy)Which of the following is not an element of the financial statements?

- future potential sales cost of inventory

- assets

- liabilities

- equity

(Figure)Which of the following is the right order of preparing the financial statements?

- income statement, statement of greenbacks flows, balance sail, statement of owner'southward disinterestedness

- income statement, statement of possessor's equity, rest canvass, statement of cash flows

- income statement, balance sheet, statement of owner's equity, argument of cash flows

- income argument, balance canvas, statement of greenbacks flows, statement of owner's equity

B

(Figure)The 3 heading lines of financial statements typically include which of the following?

- company, statement title, time menstruum of written report

- visitor headquarters, argument title, name of preparer

- statement title, time period of written report, proper noun of preparer

- name of auditor, statement title, fiscal year finish

(Figure)Which fiscal statement shows the fiscal performance of the company on a greenbacks footing?

- residuum sheet

- argument of possessor's equity

- argument of greenbacks flows

- income statement

C

(Figure)Which financial statement shows the financial position of the visitor?

- remainder canvas

- argument of owner'south equity

- statement of cash flows

- income argument

(Figure)Working majuscule is an indication of the firm's ________.

- asset utilization

- corporeality of noncurrent liabilities

- liquidity

- amount of noncurrent avails

C

Questions

(Figure)Identify the order in which the four financial statements are prepared, and explicate how the get-go three statements are interrelated.

(Figure)Explain how the following items impact equity: revenue, expenses, investments by owners, and distributions to owners.

Revenues and investments increase equity, while expenses and distributions decrease disinterestedness.

(Figure)Explain the purpose of the statement of cash flows and why this statement is needed.

Exercise Gear up A

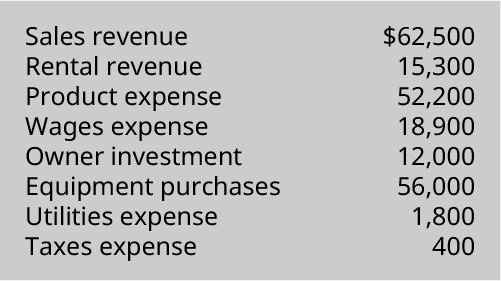

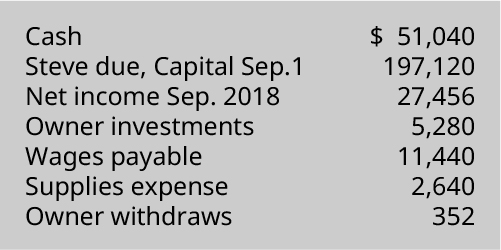

(Effigy)Ready an income statement using the following information for DL Enterprises for the month of July 2018.

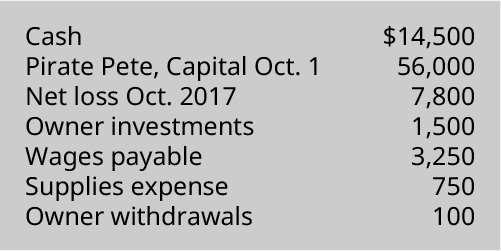

(Figure)Set a argument of owner'south equity using the information provided for Pirate Landing for the month of Oct 2018.

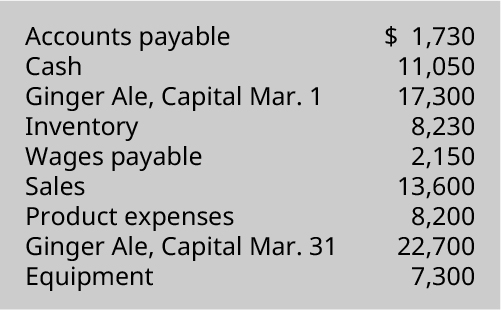

(Figure)Set up a balance sheet using the following information for the Ginger Company every bit of March 31, 2019.

Practise Set B

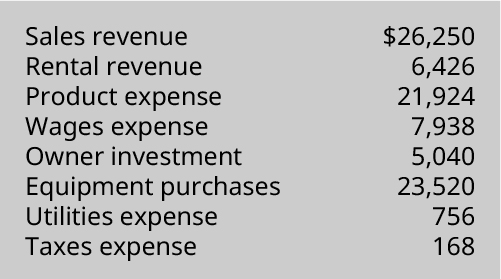

(Figure)Prepare an income statement using the following data for CK Company for the calendar month of February 2019.

(Figure)Prepare a statement of owner's disinterestedness using the following information for the Tin can Due Shop for the month of September 2018.

(Figure)Prepare a balance sheet using the post-obit information for Mike's Consulting as of January 31, 2019.

Trouble Set A

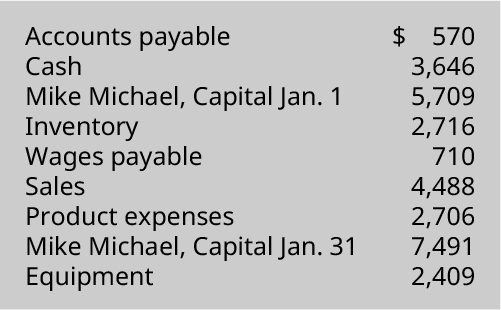

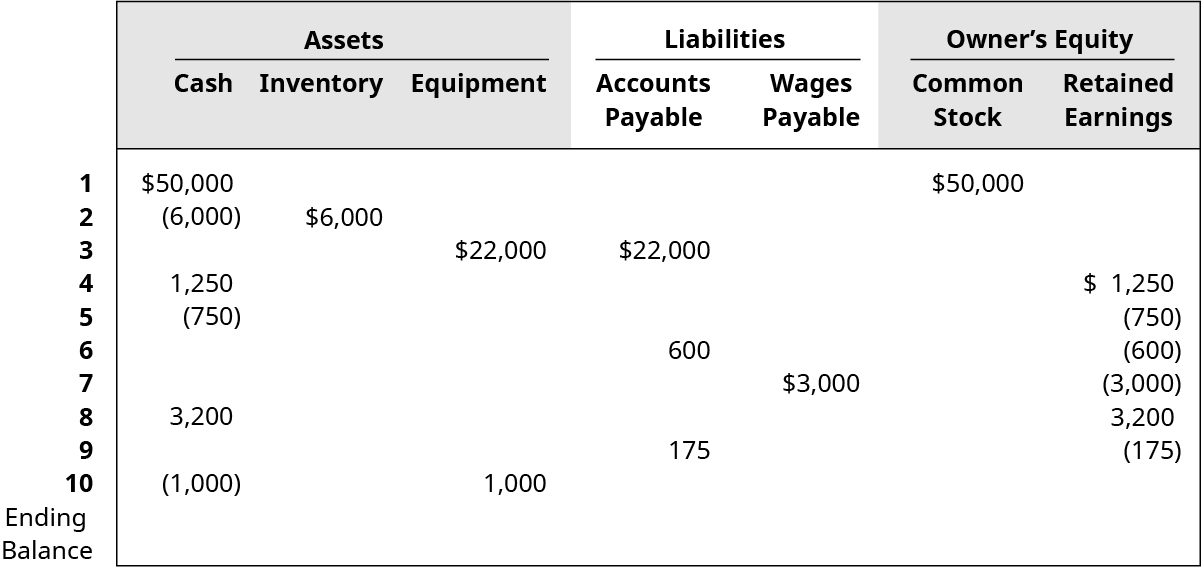

(Effigy)The following ten transactions occurred during the July thou opening of the Pancake Palace. Assume all Retained Earnings transactions relate to the primary purpose of the business.

- Calculate the ending balance for each account.

- Create the income argument.

- Create the argument of possessor's equity.

- Create the rest sail.

Thought Provokers

(Figure)For each of the following 10 independent transactions, provide a written description of what occurred in each transaction. (Figure) might assistance you.

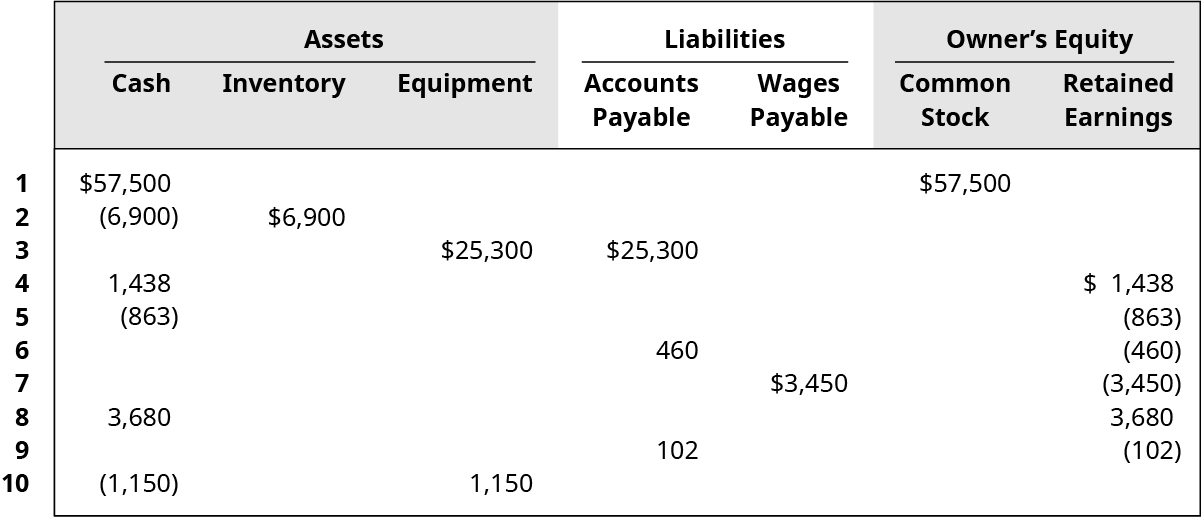

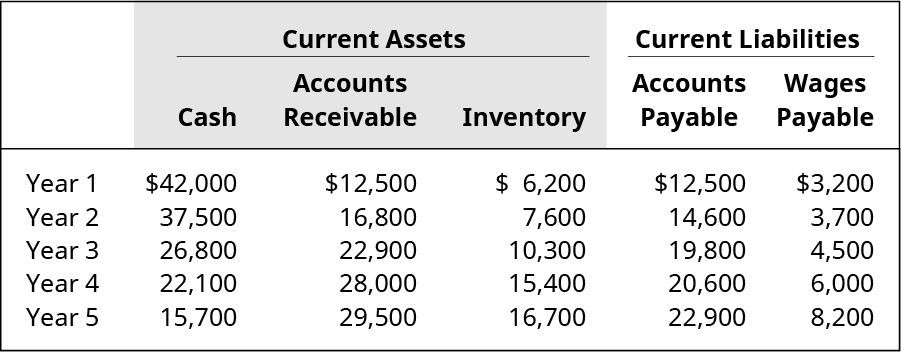

(Figure)The following historical data is from Assisi Community Markets.

Calculate the working capital letter and current ratio for each twelvemonth. What observations do you make, and what actions might the owner consider taking?

Footnotes

- 1McDonald'south Corporation. U.S. Securities and Exchange Commission ten-M Filing. March 1, 2017. http://d18rn0p25nwr6d.cloudfront.net/CIK-0000063908/62200c2b-da82-4364-be92-79ed454e3b88.pdf

- 2McDonald'due south. "Our Food. Your Questions. Breakfast." n.d. https://www.mcdonalds.com/us/en-u.s./most-our-nutrient/our-food-your-questions/breakfast.html

- 3U.S. Securities and Exchange Commission. "Waste Management Founder, 5 Other Former Top Officers Sued for Massive Fraud." March 26, 2002. https://www.sec.gov/news/headlines/wastemgmt6.htm

- 4U.S. Securities and Exchange Commission. "Waste Direction Founder, Five Other Former Acme Officers Sued for Massive Fraud." March 26, 2002. https://www.sec.gov/news/headlines/wastemgmt6.htm

- 5Publicly traded companies in the United States must file their financial statements with the SEC, and those statements must be compiled using Us GAAP. Yet, in some states, private companies can apply IFRS for SMEs (small and medium entities).

- viThe following site identifies which countries require IFRS, which use a modified version of IFRS, and which countries prohibit the use of IFRS. https://www.iasplus.com/en/resources/ifrs-topics/utilize-of-ifrs

Glossary

- comprehensive income

- change in equity of a business enterprise during a period from transactions and other events and circumstances from nonowner sources

- electric current ratio

- current assets divided past current liabilities; used to determine a company's liquidity (ability to encounter short-term obligations)

- elements of the financial statements

- categories or groupings used to record transactions and prepare financial statements

- liquidity

- ability to convert assets into cash in order to meet primarily brusk-term cash needs or emergencies

- working upper-case letter

- electric current assets less current liabilities; sometimes used equally a measure of liquidity

0 Response to "If 'ol Fashioned Toys' Revenues Are Less Than Its Expenses During the Accounting Period, Then"

Post a Comment